Business Leaders Split on Recession Forecasts as Economic Outlooks Moderate, Finds JPMorgan Chase Survey

NEW YORK--(BUSINESS WIRE)--Following a year marked by banking industry disruption, geopolitical risks and sustained macroeconomic challenges, small and midsize business leaders are sharing a more balanced outlook heading into 2024, while pulling back from previous predictions of a near-term recession, according to JPMorgan Chase’s 2024 Business Leaders Outlook survey released today.

Expectations for a recession, widely held by both small and midsize business leaders at the start of 2023, have moderated following a year of better-than-expected economic growth. In the new survey, 40% of midsize and 51% of small business leaders anticipate a recession in 2024, or believe we’re already in one, down from 65% and 61% respectively, one year ago. However, almost as many midsize business leaders (38%) say they don’t anticipate a recession in the year ahead as those that do, while 30% of small business leaders don’t anticipate a recession.

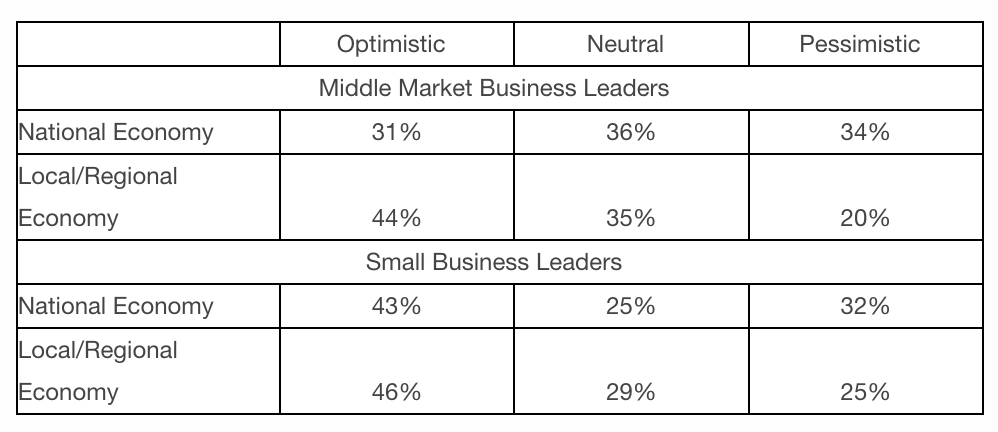

Amidst mixed economic signals, midsize business leaders are nearly evenly split in their outlook on the national economy, with 31% optimistic, 34% pessimistic and 36% remaining neutral. While this year’s optimism is higher than the 22% reported a year ago, it remains at historically low levels for the survey. When it comes to the local/regional economy, the outlook is rosier but still mixed, with 44% expressing optimism and 35% remaining neutral. For small business leaders, optimism for the national economy slightly dipped from 49% one year ago to 43% today, and perspectives on the local economy followed suit with 46% expressing optimism compared to 50% previously.

“Despite the volatility of 2023, it has been encouraging to see the resilience of US businesses and the firm pace of US consumer spending growth that has contributed to the year’s stronger economic picture,” said Ginger Chambless, Head of Research, JPMorgan Chase Commercial Banking. “Over the last few years, business leaders have not only become adept at managing through tough times and recovering from speedbumps, but confident in their ability to manage and lead through crises given how practiced they’ve become. These learnings will set them up well to weather future uncertainty.”

Business leaders are maintaining upbeat projections for their own companies in the year ahead with more than two-thirds of small and midsize business leaders optimistic about their company’s performance. The majority of midsize business leaders are expecting increased revenue/sales (61%), though these expectations are more tempered compared to previous years. Meanwhile, the 69% of small business leaders expecting increased revenue/sales is in-line with the highest levels recorded by the survey. Both small and midsize leaders anticipate greater profits (66% and 55%, respectively).

Labor and inflation top list of concerns

Small and midsize businesses continue to be vexed by some of the key issues they've faced for years, namely labor and inflation, even as they have tried to adapt and solve for these challenges. More than half of midsize business leaders (54%) cite labor-related issues—including shortages, retaining, recruiting and hiring—as one of their most significant challenges, followed by uncertain economic conditions (47%), revenue/sales growth (39%) and rising interest rates (36%). The labor challenges come as 86% of midsize business leaders say they expect to add to or maintain their current headcount in the next 12 months.

“Today’s business leaders are not strangers to the challenges before them, and have remained nimble and primed for opportunities despite continued uncertainty,” said John Simmons, Head of Middle Market Banking & Specialized Industries, JPMorgan Chase Commercial Banking. “The most resilient leaders focus on continuous improvement, iterating with each challenge to make strategic investments in their operations, adopt new technologies and focus on their people to move their business forward.”

More than one-third of small business leaders (35%) report inflation as one of their most significant challenges, with rising taxes (19%) and the ability to grow sales/revenue (18%) also top concerns. The inflation worries persist as 90% of small business leaders say it has had at least some impact on their expenses, and the majority expect rising costs in areas like labor, energy and materials to continue. Despite this, 41% of small business leaders said that inflation will motivate them to accelerate their business plans, rather than scale back on (26%) or maintain (33%) current operations.

“Small business owners continue to demonstrate resilience, proving time and time again why they are the lifeblood of the US economy,” said Ben Walter, CEO of Chase for Business. “Despite nagging inflation and concerns of recession, the majority of small business owners feel like they can weather any storm, and even expect to increase in revenue in 2024.”

Warming up to AI

While businesses’ adoption of artificial intelligence (AI) tools, such as generative AI and language processing software, is not yet widespread, business leaders are giving more consideration to them to support a growing number of functions. Of the 46% of midsize businesses currently using or considering adopting AI, popular applications for the technology include business operations (69%) and internal/external communications (63%). Nearly half are currently or considering using AI for financial management/accounting (48%) and human resources/training purposes (47%).

While small businesses find social media tools, virtual meeting platforms and cloud technologies more essential to their business than AI, it ranks as the technology they’re most likely to add in the coming year, with 46% of small businesses planning to do so.

Innovation Economy companies remain optimistic

US-based founders, CEOs and CFOs of Innovation Economy (IE) businesses were also tapped for their insights. The participating IE businesses consisted of high-growth, venture-backed, founder-led startups and companies in the Technology, Disruptive Commerce & Internet, Life Sciences, HealthTech and Climate Tech industries.

Founders and entrepreneurs are resilient and optimistic by nature, which is reflected in the IE survey findings: 43% are optimistic about the national economy in the year ahead and 50% are optimistic about the local/regional economy. Similarly, IE business leaders are bullish on their prospects, with 74% expressing optimism for their company’s performance.

While the majority of IE business leaders (67%) note that declining tech valuations have had a negative impact on their ability to raise capital, most (54%) are confident they have raised enough capital to hold off on raising additional funds over the next year. Twenty-four percent note they plan to raise new equity in 2024.

Despite this optimism, IE business leaders do anticipate challenges in the year ahead, including the availability of capital and credit (52%). They are also confronting the same challenges as midsize business leaders related to revenue and sales growth (48%) and uncertain economic conditions (46%).

When asked about their long-term vision or goal for their company, 50% of IE respondents say it is to be acquired and 15% expect to go public via an initial public offering (IPO).

For more information on the Business Leaders Outlook survey, please view the midsize and small business and Innovation Economy reports.

Survey Methodology

JPMorgan Chase’s Business Leaders Outlook survey was conducted online from November 9-20, 2023, for small businesses (annual revenues between $100,000 and $20 million) and from November 16 – December 7, 2023, for midsize businesses (annual revenues between $20 million and $500 million). In total, 1,829 business leaders in various industries across the US participated in the survey. For year-over-year trends, current data is compared to data collected in the fourth quarter of previous years. The results of this online survey are within statistical parameters for validity, and the error rate is plus or minus 3.1% for the small business findings and plus or minus 3.5% for the midsize business findings, both at the 95% confidence level. In addition, 155 Innovation Economy companies participated in the survey. 40% of responding companies are between five and 10 years old and 66% of respondents reported revenue under $20mm. For these companies, the results of the online survey are within statistical parameters for validity, and the error rate is plus or minus 7.9%, at a 95% confidence level.

About JPMorgan Chase

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm based in the United States of America (“U.S.”), with operations worldwide. JPMorgan Chase had $3.9 trillion in assets and $317 billion in stockholders’ equity as of September 30, 2023. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, the Firm serves millions of customers in the U.S., and many of the world’s most prominent corporate, institutional and government clients globally. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com.

© 2024 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. Deposits held in non-U.S. branches are not FDIC insured. Visit jpmorgan.com/cb-disclaimer for disclosures and disclaimers related to this content.

Contacts

Media Contacts:

Midsize Businesses: Melinda Bonner, melinda.bonner@chase.com

Small Businesses: Devi Kinkhabwala, devi.kinkhabwala@chase.com

Innovation Economy: Eileen Nolan, eileen.nolan@jpmorgan.com