The Outlook for 2026 Has Less Uncertainty Than Last Year, but Not Necessarily More Certainty

Written by: Sophia Kearney-Lederman, Senior Economist, FHN Financial

2025 reinforced a familiar but critical lesson – uncertainty remains the only constant. Last year wasn’t the first time the economy and markets have dealt with uncertainty – just look at the five years post-pandemic for proof – nor is it abnormal for a new presidential administration to initiate change at the start of a new term. But the changes to tariffs, immigration, tax policy and spending from President Trump last year were unprecedented, heightening uncertainty.

By the end of 2025, however, it felt as if markets and the economy had adjusted to uncertainty as the new norm. So, as we enter 2026, it’s not that there is any certainty but there is cautious optimism for less uncertainty than last year. We expect any policy changes and impact from Washington will be a continuation of the changes already instituted last year, shifting the drivers of economic growth from government spending and government-supported consumption to private investment and foreign trade. Geopolitical events remain an outsized, and unpredictable, risk to the outlook but we will focus here on the things we can at least try to project.

Growth

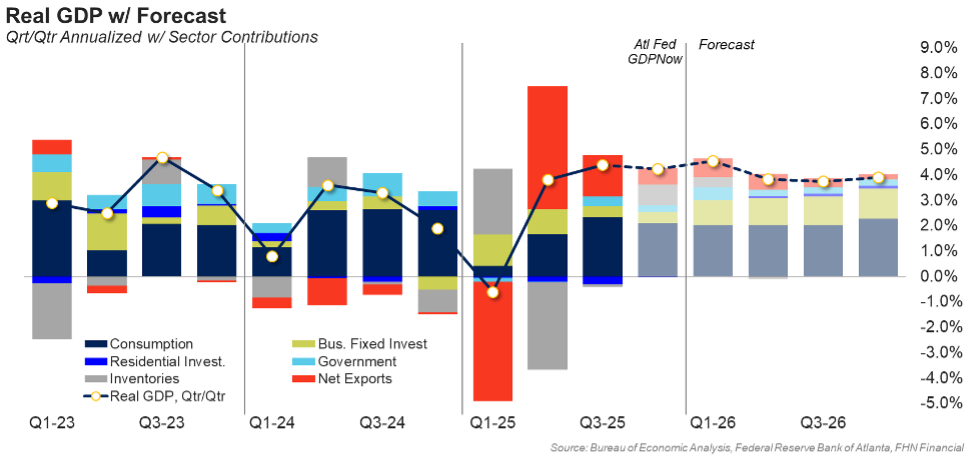

All things considered, the economy showed remarkable resilience in 2025. Quarterly growth averaged 3.0%[1] in 2025, faster than the 2.4% average in 2024 even with negative growth in Q1. We forecast average quarterly growth will be 4.0% in 2026.

Tariffs and trade factored heavily in growth in 2025. In the first half of the year, imports surged as businesses worked to get inventories in ahead of tariffs, pulling real GDP negative before reversing in Q2 when tariffs went into place. In the second half of the year, trade boosted growth as imports remained subdued and exports increased. We expect trade will continue to be a positive contributor in 2026 but to a much smaller degree as tariffs seem, for now, to be largely settled.

There are still some uncertainties here, however. One is the possibility policies could change as seen at the start of the year with President Trump’s threat of additional tariffs on European countries in response to negotiations over Greenland. While those additional tariffs have been called off, it was a reminder that tariff policies are still in flux. Then, there is the Supreme Court case over the constitutionality of President Trump’s emergency tariffs using Article 1. It remains to be seen when the courts will rule on the case and what the outcome will be, keeping this a lingering question mark for now.

Private business investment, and specifically investment related to AI, was another big contributor to growth in 2025. In the first nine months of 2025, AI-related investment surpassed the contribution from IT-related investment during the dot-com boom in 2000, according to the St. Louis Federal Reserve. Investment in AI (which includes software, hardware, intellectual property and data centers) accounted for 30% of GDP growth in Q2 ’25 before slowing to 11% in Q3. We expect private investment generally – and technology-related investment more specifically – to continue to drive growth in 2026.

Labor Market

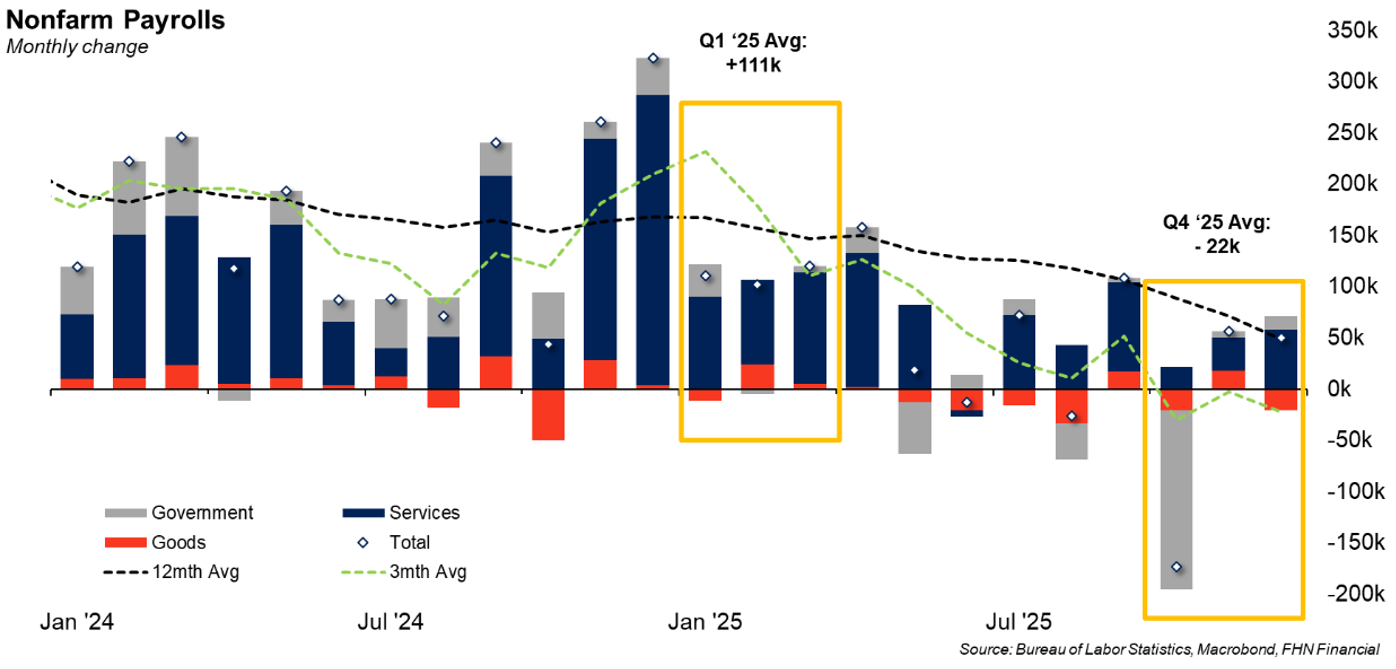

One of the big conundrums of 2025 was that strong GDP growth did not translate into strong job growth. While the economy picked up steam as the year went on, job growth slowed from the start to the end of 2025. Nonfarm payroll gains averaged 111k in Q1 ’25 and -22k in Q4 ’25, putting the full year average at 49k. While some of the weakness in the final quarter of last year was tied to the federal government shutdown – the big drop in government payrolls came in October – there is no doubt that hiring slowed last year even outside of this. Goods-related payrolls contracted in 2025 with losses in manufacturing and mining outweighing the small gain in construction. Service-related payrolls account for all of the gains in hiring last year, with most hiring coming from health care.

The combination of uncertainty and the boom in AI meant businesses were on the back foot when it came to adding people to payrolls last year. This slowdown in hiring is why the unemployment rate rose from 4.0% in January to 4.6% in November, before ending the year at 4.4%. The rising risks to the labor market are why the Fed cut rates in September and continued through December, lowering the fed funds target rate 75bp to 3.50% - 3.75%. We expect the labor market will stabilize this year with payroll gains moving back toward 100k on average, stronger than 2025 but still a bit soft as businesses navigate through these uncharted waters of what AI and related technology will mean for the labor market.

Consumer Spending

Consumers noticed the softness in the labor market last year and it is part of why consumer sentiment was low. Yet at the same time, consumers kept spending through the uncertainty of 2025. Consumption added 2.34 percentage points to real GDP in Q3 ’25 and the consumer spending data we have for Q4 shows continued spending growth with personal consumption up 0.5% per month in both October and November.

But not everyone was spending to the same extent as the “K-shaped” economy really took hold. High income households continued to account for a greater proportion of consumer spending while low-income households spent only enough to keep up with inflation. There were signs of this divergence even in the strong October and November spending data with the personal saving rate falling to 3.5%, the lowest level since late 2022, suggesting consumers dipped into savings to keep spending.

Consumer spending built on a narrow base, as it is now, can limit upside growth potential. First quarter consumption can often be soft as consumers pull back after the holidays. The risk of winter weather is also a regular source of potential impact this time of year. There are, however, a couple of potential upsides for consumption in the first half. The most notable should come in the form of higher tax rebates and other tax changes from the OBBBA, which should add some support for spending in 1H 2026. We forecast consumer spending will continue to grow in 2026, contributing an average of 2.0 percentage points to real GDP per quarter.

Inflation

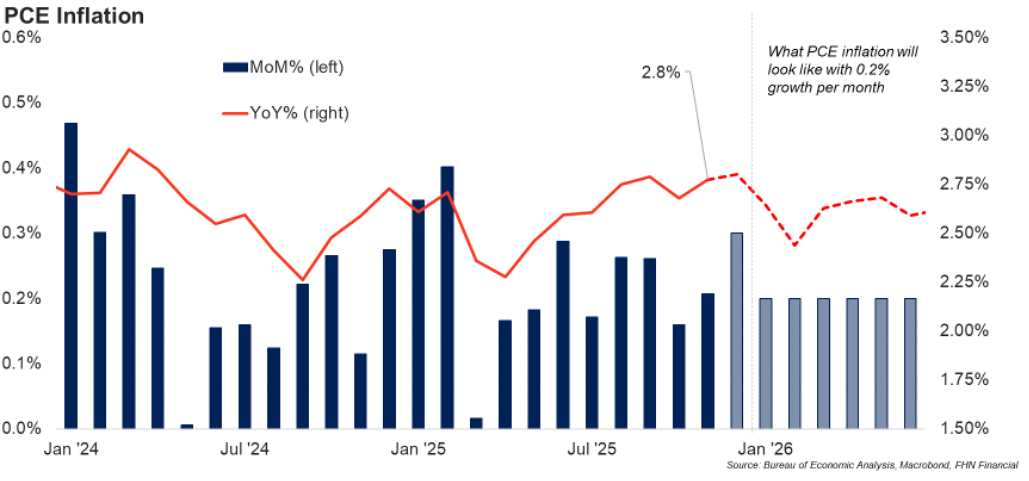

Which brings us to the cost of things and the outlook for inflation in 2026. All things considered, inflation is starting 2026 in a better place than we all worried it would be in the middle of 2025. CPI started 2025 at 3.0% year-over-year, slowed to 2.3% in April, picked up to 3.0% in September as tariff inflation became evident, and then fell to 2.7% in December. The PCE, which is the Fed’s preferred inflation measure, is 2.8% as of November, the most recent data available due to the government shutdown.

Inflation moving back towards the Fed’s 2.0% target is critical for further rate cuts this year. The January and February inflation data will be highly watched by the Fed as the start of the year is often when firms re-set prices. While businesses still report cost pressures related to tariffs, price pressure passed along to consumers is waning, particularly in industries like retail and restaurants. According to the January Federal Reserve Beige Book, “Several contacts that initially absorbed tariff-related costs were beginning to pass them on to customers as pre-tariff inventories became depleted or as pressures to preserve margins grew more acute. But contacts in a few industries—like retail and restaurants—were reluctant to pass costs along to price-sensitive customers.”

We expect tariff inflation to fall out of consumer inflation by mid-2026. Monthly gains in PCE inflation averaged 0.20% in 2024 and 0.22% in 2025. If PCE averages 0.2% per month in the first half of 2026, PCE inflation will fall to 2.5%. January and February of 2025 saw the biggest monthly gains of 0.35% and 0.40%, respectively, so the first two months of 2026 have the biggest room for improvement if the monthly gains are more moderate this year.

Bottom Line

There is cautious optimism for the economy in 2026. The hope is for some stabilization and macro normalization. In its December projections, the Fed echoed these expectations with a forecast for a pick-up in growth, a slow-down in inflation, and a stabilization in the unemployment rate.

At the January FOMC meeting, the Fed kept rates steady, stating that the balance of risks had moved toward neutral. The December 2025 dot plot showed the median expectation from FOMC participants was for one 25-basis point rate cut this year, but the range of projections was wide on both sides of that median. In the January press conference, Chair Powell indicated no one on the committee’s base case was for a rate hike this year. Markets are pricing in between one and two cuts this year, with the first cut priced in for the June FOMC, which will be the first meeting with a new Fed Chair.

The FOMC is navigating to the neutral rate at this stage, and with the fed funds target rate now at 3.5%-3.75%, it is within the plausible range of neutral estimates. It is, however, still 75 basis points from the median of 3.0%. There is room for the Fed to cut rates this year, but it will come down to what happens on both sides of the Fed’s dual mandate. With monetary policy now in fine tuning mode, the Fed starts the year back in wait-and-see for the data to confirm the outlook before making further policy decisions.

About the Author:

Sophia is the Senior Economist at FHN Financial. She provides regular economic updates and presentations for First Horizon Bank, the parent company of FHN Financial. As Senior Economist, she integrates Chris Low's macro-economic views and interest rate forecasts with her own economic analysis of regional markets and specific industries.

She served as a Senior Business Analyst, Global Commercial Services with American Express from 2017 to 2020. Prior to her tenure at Amex, Sophia trained as an Economic Analyst with FHN Financial for three years.

Sophia graduated magna cum laude from Washington and Lee University with a B.A. in Economics and Spanish. She is a member of Phi Beta Kappa and Omicron Delta Epsilon. Sophia was born, raised, and currently lives in New York City.

This document or presentation was prepared by an FHN Financial Economist and is not subject to all of the independence and disclosure standards applicable to retail investors. This report may not be independent of FHN Financial’s proprietary interests. FHN Financial sales representatives, traders and other professionals may provide oral or written market commentary or trading strategies to our customers that reflect opinions that are contrary to the opinions expressed herein. FHN Financial’s investment advisory businesses may make investment decisions that are inconsistent with the recommendations or views expressed in this report. Although this information has been obtained from sources which we believe to be reliable, we do not guarantee its accuracy, and it may be incomplete or condensed. This is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. All herein listed securities are subject to availability and change in price. Past performance is not indicative of future results, and changes in any assumptions may have a material effect on projected results. Ratings on all securities are subject to change. The views expressed herein accurately reflect the author’s personal views about the data, news, trends, events, etc., discussed herein or any subject securities or issuers. No part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views contained in the Notes. FHN Financial Capital Markets, FHN Financial Portfolio Advisors, and FHN Financial Municipal Advisors are divisions of First Horizon Bank. FHN Financial Securities Corp. and FHN Financial Capital Assets Corp. are wholly owned subsidiaries of First Horizon Bank. FHN Financial Securities Corp. is a member of FINRA and SIPC — http://www.sipc.org. FHN Financial Municipal Advisors is a registered municipal advisor. FHN Financial Portfolio Advisors is a portfolio manager operating under the trust powers of First Horizon Bank. None of the other FHN entities, including FHN Financial Capital Markets, FHN Financial Securities Corp., or FHN Financial Capital Assets Corp. are acting as your advisor, and none owe a fiduciary duty under the securities laws to you, any municipal entity, or any obligated person with respect to, among other things, the information and material contained in this communication. Instead, these FHN entities are acting for their own interests. You should discuss any information or material contained in this communication with any and all internal or external advisors and experts that you deem appropriate before acting on this information or material. FHN Financial, through First Horizon Bank or its affiliates, offers investment products and services. Investment products are not FDIC insured, have no bank guarantee, and may lose value.

The views expressed in the Commercial Factor website are those of the authors and do not necessarily represent the views of, and should not be attributed to, the International Factoring Association.

[1] We don’t have official data for Q4 yet, so we are using the Atlanta Fed’s GDPNow for Q4 ’25 which is tracking 4.2% as of publication.