Breaking Down the Findings of the IFA’s Annual Factoring Industry Survey

The International Factoring Association released its 15th annual Business Profile and Performance Survey Industry Report, so we dove into the data to provide some of the most pertinent takeaways from the findings, including a look at the impact of the COVID-19 pandemic on business development, operations and more.

BY PHIL NEUFFER, MANAGING EDITOR, COMMERCIAL FACTOR

To put it mildly, 2020 was a challenging year and although business came to a halt at certain points and for certain sectors, the factoring industry dealt with the initial shockwaves of the COVID-19 pandemic to keep on providing working capital to businesses from across the United States and Canada.

To capture the year in factoring, the International Factoring Association conducted its 15th annual Business Profile and Performance Survey Industry Report, with Industry Insights collecting and analyzing the data. Based on survey responses from IFA members in the U.S. and Canada collected during Q1/21, the report includes an in-depth look at company and client details, operating metrics and information on business development, bad debts and credit as well as a section on the impact of the COVID-19 pandemic.

In this article, we’ll take a look at some of the most pertinent data from the report.

Revenue and Operations

Most factors achieved $5 million or under in total gross revenue in 2020, with 28% reporting marks below $1 million, while 22.9% recorded between $2.1 million and $5 million and 18.6% produced between $1 million and $2 million. Compared with 2019, 45.5% of factors reported a decrease in revenue in 2020, while 48.3% reported an increase.

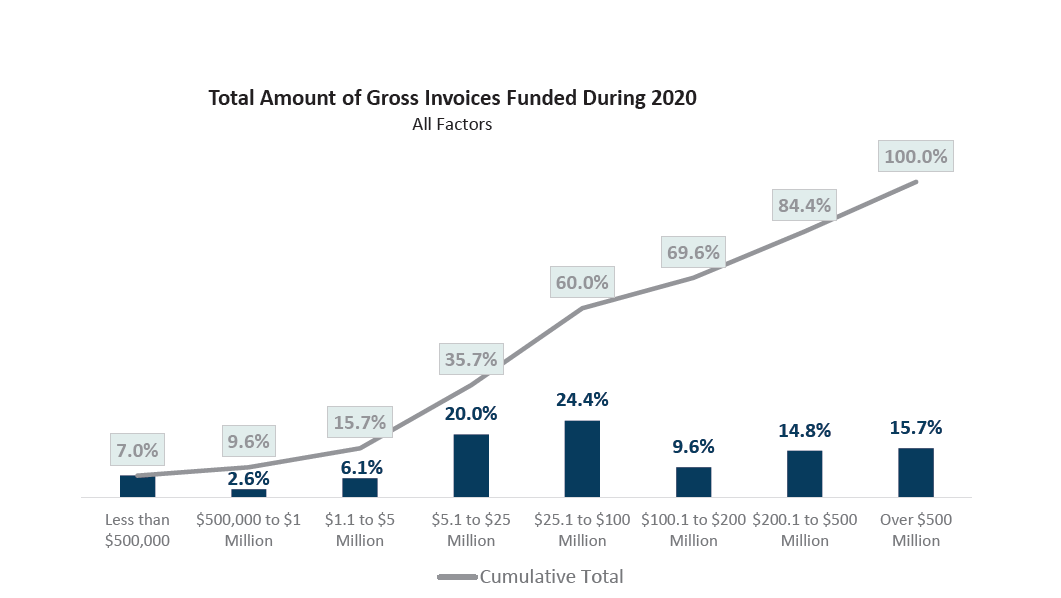

In terms of gross invoices funded during 2020, 24.4% of factors recorded somewhere between $25.1 million and $100 million and 20% logged between $5.1 million and $25 million. Interestingly, the third most cited range of gross invoices funded was more than $500 million (15.7%).

Bank lines of credit (38.4%), personal finances of owner/partners (24.8%) and private investors (22.8%) accounted for the majority of the sources of funding for factors in 2020. Most factors maintained their funding levels despite the COVID-19 pandemic, with only 7.5% reporting a reduction in external funding after the pandemic began.

Recourse factoring made up 83.8% of the transactions completed by factors in 2020 compared with 80.5% in 2019. That mark may be on the rise, as factors projected 85.7% of factoring transactions will be of the recourse variety in 2021.

Client Mix and Business Development

Transactions somewhere between $50,000 to $500,000 were considered to be in the “sweet spot” for the majority of factors. In addition, a little more than a quarter of factors (28%) reported that their average monthly deal size was under $50,000, making it the most popular average monthly deal size. In total, factors increase their average deal size by 8% in 2020 compared with 2019.

Transportation was the most popular sector for factors to work with in 2020, with 36.8% of gross invoices going toward the industry, and sector distribution was largely unaffected by the COVID-19 pandemic.

When looking at client mix, factors averaged a 31.1% rate of new customers, which was down from 34.6% in 2019. Despite the change in the average in 2020, the median percentage of new clients stayed steady at 25%.

Word-of-mouth referral from a current or previous client was the most popular source of business, leading to 36.8% of the deal activity booked by factors in 2020, with non-client referral sources providing 27.7% of deal flow.

Closing on deals quickly is obviously important, and the median number of days between receiving an application and providing funding was five days for factors in 2020. As is always the case, some leads did not pan out and, in 2020, 40.6% of the time a client didn’t fund with one factor was because they got funding from another, making it the most cited roadblock to closing deals.

New government funding programs like the Paycheck Protection Program also had an impact on business development. Most factors reported that at least some of their clients received funding from the PPP or Small Business Administration in 2020, with 31.1% of factors saying such funds were extended to up to 20% of their clients.

Write-Offs and Fraud

An average of 8.8% of clients used credit insurance in 2020. The insurance was usually filed under the name of the factor (57.1%) instead of the client (42.9%).

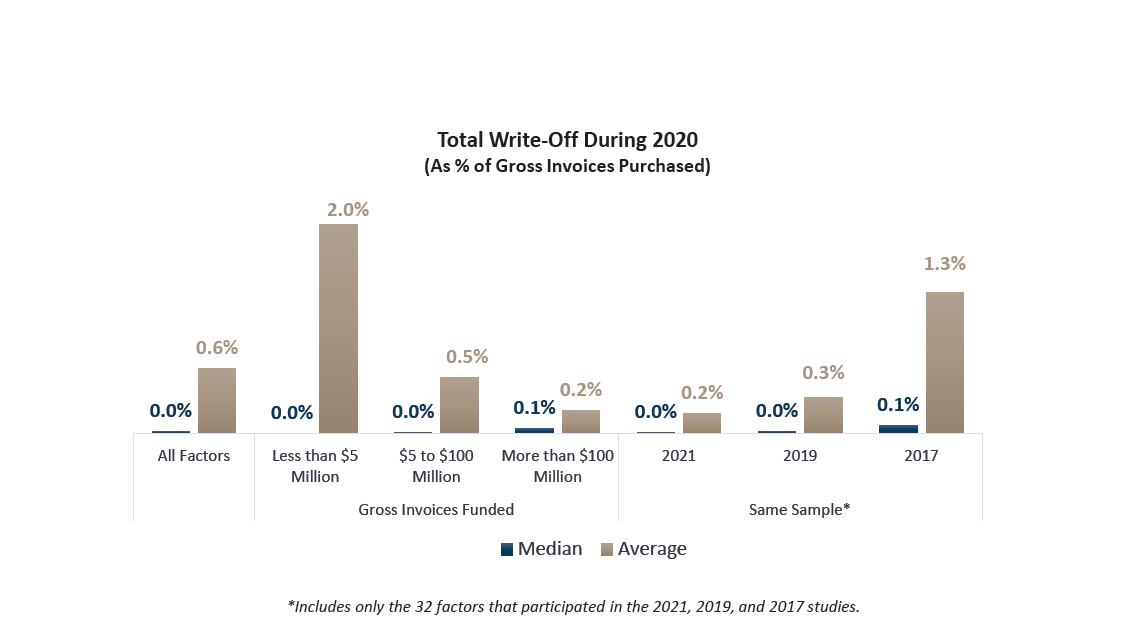

Respondents to the survey reported only 0.6% of their gross invoices purchased were written off in 2020.

When clients did not pay in 2020, it was usually because they were unwilling to do so, perhaps due to a dispute (42.3%), or because they were unable to do so, possibly due to insolvency issues (31.5%).

When it came to fraud, more than half (53.2%) of factors said the number of fraud cases they experienced in 2020 stayed the same and 32.1% said the number decreased.

Remote Work and Tech

Hiring should be on the rise in the factoring industry this year, as 54.8% of factors expect to bring on new personnel.

Where new and current employees will actually be working by the end of the year is another question and one without a clear answer. When factors were asked what percentage of employees currently work remotely due to the COVID-19 pandemic, the two most popular responses were 80% to 100% (38.4%) and no more than 20% (33%). This dichotomy will likely continue, as 41.4% of factors said no more than 20% of their workforce will return to the office in 2021, while 35.6% expect 80% to 100% of their workforce to do so.

Regardless of where employees work, factors will need the right technology to remain competitive. For the most part, factors are largely content with their technological expertise, with 44% describing themselves as average and 37.1% describing themselves as somewhat above average. In terms of technology solutions in place, 78.3% of factors use cloud computing, 51.3% use a redundancy service, 48.7% use in-house servers and 48.7% use remote servers.

The IFA’s 2021 Business Profile and Performance Survey Industry Report features much more data than we’ve covered in this article. The full report can be purchased from the IFA’s online store.